Opinion Piece John O’Donnell – January 2024

Increased costs of living is a very big issue across Australia and continues to increase.

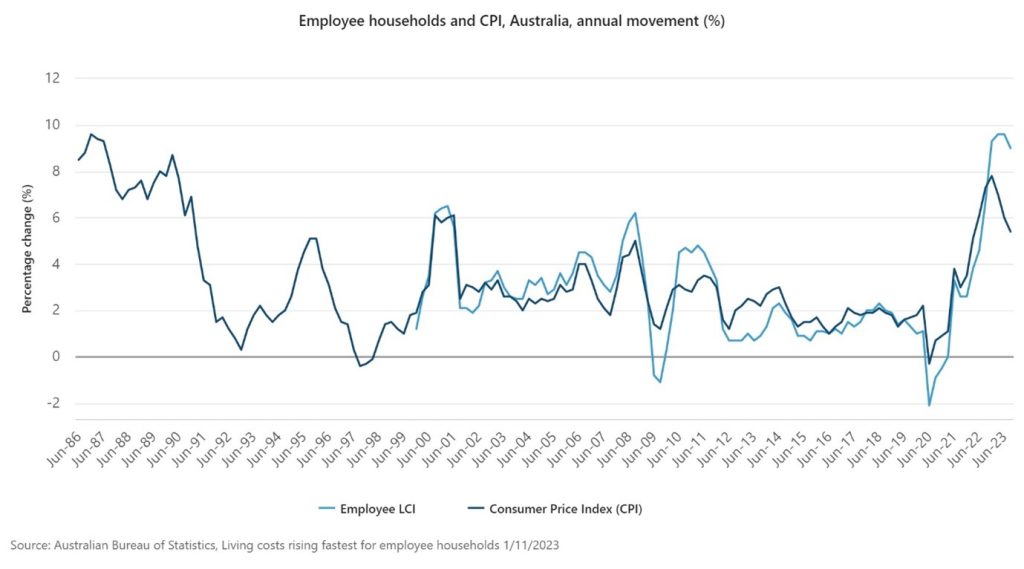

A key ABS document provides valuable information in regards to increasing Living Cost Indexes (LCI) and CPI:

Increasing interest rates over the year have contributed to annual living cost rises ranging from 5.3 per cent to 9.0 per cent for different household types. Most households recorded higher rises than the 5.4 per cent annual increase in the CPI.

A significant difference between the Living Cost Indexes and the CPI is that the Living Cost Indexes include mortgage interest charges rather than the cost of building new dwellings.

Higher automotive fuel prices and insurance premiums also contributed to increases in annual living costs for all household types.

The document includes LCL and CPI information since 1986, and highlights the current high LCL’s and CPI’s.

There is a really good graph of real household disposal income in Australia since 1960 in the linked article below, it is scary:

Major concerns in relation to natural disasters, inadequate mitigation expenditure, cost of living and rising insurance costs

There are major concerns in relation to natural disasters, inadequate mitigation expenditure, cost of living and rising insurance costs for Australians.

The Disaster Ready Fund (DRF) is the Australian Government’s flagship disaster resilience and risk reduction initiative:

Australia’s exposure to disaster risk continues to increase, with new risks emerging at an accelerated pace. Extreme heat, heavy rainfall, coastal inundation, and bushfires are increasingly impacting our communities, environment and economy.

The Australian Government has announced up to $1 billion for the Disaster Ready Fund (DRF) over five years, from 1 July 2023. Round One provided $200 million of Commonwealth investment for 187 projects in 2023-24.

The DRF is the Australian Government’s flagship disaster resilience and risk reduction initiative which will deliver projects that support Australians to manage the physical and social impacts of disasters caused by climate change and other natural hazards.

The DRF was established through the Disaster Ready Fund Act 2019 and replaces the Emergency Response Fund which terminated on 30 June 2023.

The DRF is a positive step forward but the author considers not adequate for the nation. The shift of relative funding effort towards up front mitigation and resilience building is a good step forward but will unlikely be anywhere near adequate to greatly reduce ongoing natural disasters.

Just 3 per cent of disaster funding is invested prior to an event to reduce the impact of future disasters, as noted in a Deloitte Access Economics (2022) report https://www2.deloitte.com/content/dam/Deloitte/au/Documents/Economics/deloitte-au-dae-economic-reality-check-minderoo-foundation-17012022.pdf: This percentage may have changed a little with the DRF funding.

As an example of natural disaster costs, the 2019/ 20 bushfires burnt over 17 million hectares and they were also very costly, estimated by AccWeather to be $110 billion in terms of total damage and economic loss. https://www.accuweather.com/en/business/australia-wildfire-economic-damages-and-losses-to-reach-110-billion/657235

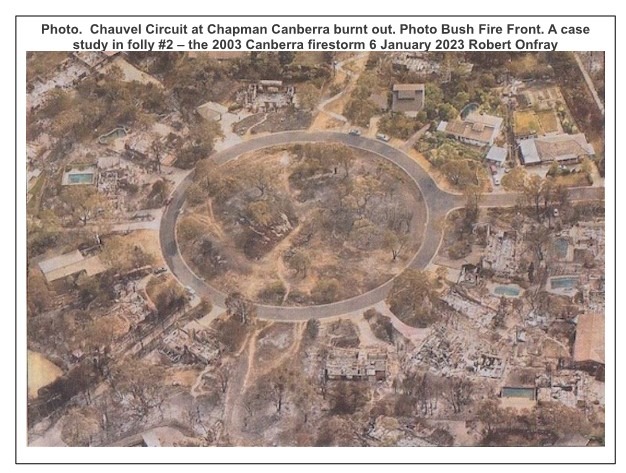

Large numbers of Australian communities, individuals and businesses aren’t adequately protected from bushfires, nor are firefighters, nor infrastructure and investments. This is evident in the extent of bushfires, lost lives, and impacts on large numbers of communities/ towns and cities, infrastructure, fire fighters and forests and fauna. Current bushfire mitigation and suppression measures are not working in many locations and little is changing to rectify this across SE Australia. Bushfire disaster mitigation measures are very localised, often concentrated near a small number of communities, scattered, often small in size and not undertaken at adequate levels across the landscape. Prescribed burning in forests for all states of Australia, except for WA, is around the 1 % (occasionally up to 2 %) of forests per year and not adequately applied across landscapes.

Photo. Chauvel Circuit at Chapman Canberra burnt out. Photo Bush Fire Front. A case study in folly #2 – the 2003 Canberra firestorm 6 January 2023 Robert Onfray

Number 2 concern relates to inadequate natural disaster management and mitigation and associated rising insurance costs for home owners and businesses. Due to the inadequate funding on disaster mitigation by governments at all levels, we the people, are paying for these disasters in terms of high insurances.

Informaion on this is outlined in “Natural disasters force Australians to ditch home insurance By Roxanne Libatique Oct 17, 2023 Insurance Business”:

Two in five Australians affected by natural disasters are left with no choice but to ditch their home insurance amid the rising cost-of-living in the country, according to financial comparison site Mozo.

Mozo’s latest research found that Australians with home insurance currently pay $316 more on average than they did last year, with more than half of the respondents (62%) sharing they felt “out of control” with their expenses as the average annual cost of home insurance premiums totals $1,460 annually.

“The amount of Australians that have resorted to cancelling their home insurance because they can’t afford it is shocking,” said Mozo money expert Rachel Wastell. “But what’s more concerning is many are likely paying these rising premiums without realising they’re underinsured.”

The article notes the huge increases of insurance in disaster-prone areas:

Among the respondents who cancelled their home insurance policy in the last 12 months “because it got too expensive”, two in five (39%) were living in areas affected by natural disasters.

Australians living in bushfire-prone areas were most likely to see an increase in their insurance premiums (42%), followed by those in areas impacted by floods (32%). Meanwhile, those living in areas impacted by rising ocean levels were more than twice as likely to have cancelled their home insurance policy than those in unaffected areas, with a 40% rise in premiums on average.

As noted by Mozo Aussies bail on home insurance as natural disasters increase costs By Jack Dona · Last updated Friday, 13 October 2023:

The data shows that, for bushfire and flood-affected customers, home insurance premiums rose by more than 30% on average over the last 12 months.

The author notes that many home and contents insurances around the NSW Clarence are around $6000 to $7000 per year, a huge cost, and way above average Australian costs.

The huge increases in home and business insurances are further adding to Australian cost of living pressure.

Number 3 concern is the amount of our taxes going to provide for post disaster funding such as bushfires and floods is very high.

Strong action required in relation to cost of living, natural disasters and rising insurance costs

Labor says it’s looking for ways to ease cost-of-living pressures. Just don’t mention the stage-three tax cuts Peter Hannam:

The prime minister, Anthony Albanese, used his first media conference of 2024 to declare he had ordered the Treasury and finance departments to conjure ideas about easing cost-of-living pressures without stoking inflation. Tinkering with the tax cuts, though, is not among them even if Treasury had reportedly provided advice about options for change.

There are huge opportunities in relation to reducing disaster costs and associated insurance costs. Here’s some ideas for governments, Treasury, finance departments and other agencies about easing cost-of-living pressures without stoking inflation and reducing disasters, disaster costs and insurance:

Number 1 is to increase the 3 per cent of disaster funding that is invested prior to bushfire, flood and other disaster events to reduce the impact of future disasters, as noted in a Deloitte Access Economics (2022) report. Maybe increase to 50 % of disaster funding spent of mitigation and preparedness.

Number 2 pertains to dramatically increase fire mitigation funding, noting that there is further disaster funding detail in 2020 Menzies Research Centre Strengthening Resilience: Managing natural disasters after the 2019-20 bushfire season https://www.preventionweb.net/media/82890/download:

Number 3 is to dramatically increase prescribed burning and reduce high fuel loads across forested landscapes, undertaking prescribed burning across 8-10 % of forested landscapes per year.

Number 4 relates to reducing the focus on bushfire suppression and big plane fleets at the expense of fire mitigation. There are large economic costs of this approach.

Number 5 is to consider adopting approaches being used in the USA in relation to fire adapted communities, Firewise, local fire safe councils, the Ready, Set, Go! Program, improved funding to reduce fuel loads, undertaking prescribed burning, forest thinning and community involvement in fire management all need to be considered for Australia, but aren’t being. To be frank, most communities in Australia are not adequately protected.

Number 6 is to undertake whole catchment approaches/ hydraulic flood studies to assist in flood mitigation planning, these important studies are underway in a number of NSW north coast river catchments.

Number 7 is to consider adopting innovative flood approaches such as room for the river program undertaken on 30 flood mitigation projects in the Netherlands and other areas across the world, undertaken in a sustainable manner to reduce flood impacts on communities.

Number 8 is to urgently review increasing cost of living insurance rises across Australia and the solutions available in relation to natural disaster funding and costs.

Number 9 is to apply greater mitigation funding to those areas/ regions that are suffering from large increases in insurances due to natural disasters and which are where insurances are becoming unaffordable.

Hopefully, Treasury and finance departments will address these ideas about easing cost-of-living pressures without stoking inflation.